.svg?auto=webp)

Integrate payments with ease

Receive end-to-end implementation support

Build without the overhead

Grow revenue and maximize your payments margins

Boost revenue per customer with optimized customer experiences.

Reduce your total cost of payment processing.

Gain in-depth control of merchant pricing.

Add a markup on top of the buy-rate so you can monetize the difference and even adjust the end-user rate on a customer-by-customer basis.

Enable payments with lower development effort and faster integration

Shorten your time to market, enjoy a flexible user experience and monetize payments in your platform with our suite of pre-built hosted solutions.

Our one-stop self-serve portal that merchants can access via SSO and review transactions, handle disputes and chargebacks, run reports, review payouts and more. In addition, you can fully customize the branding that your merchants see.

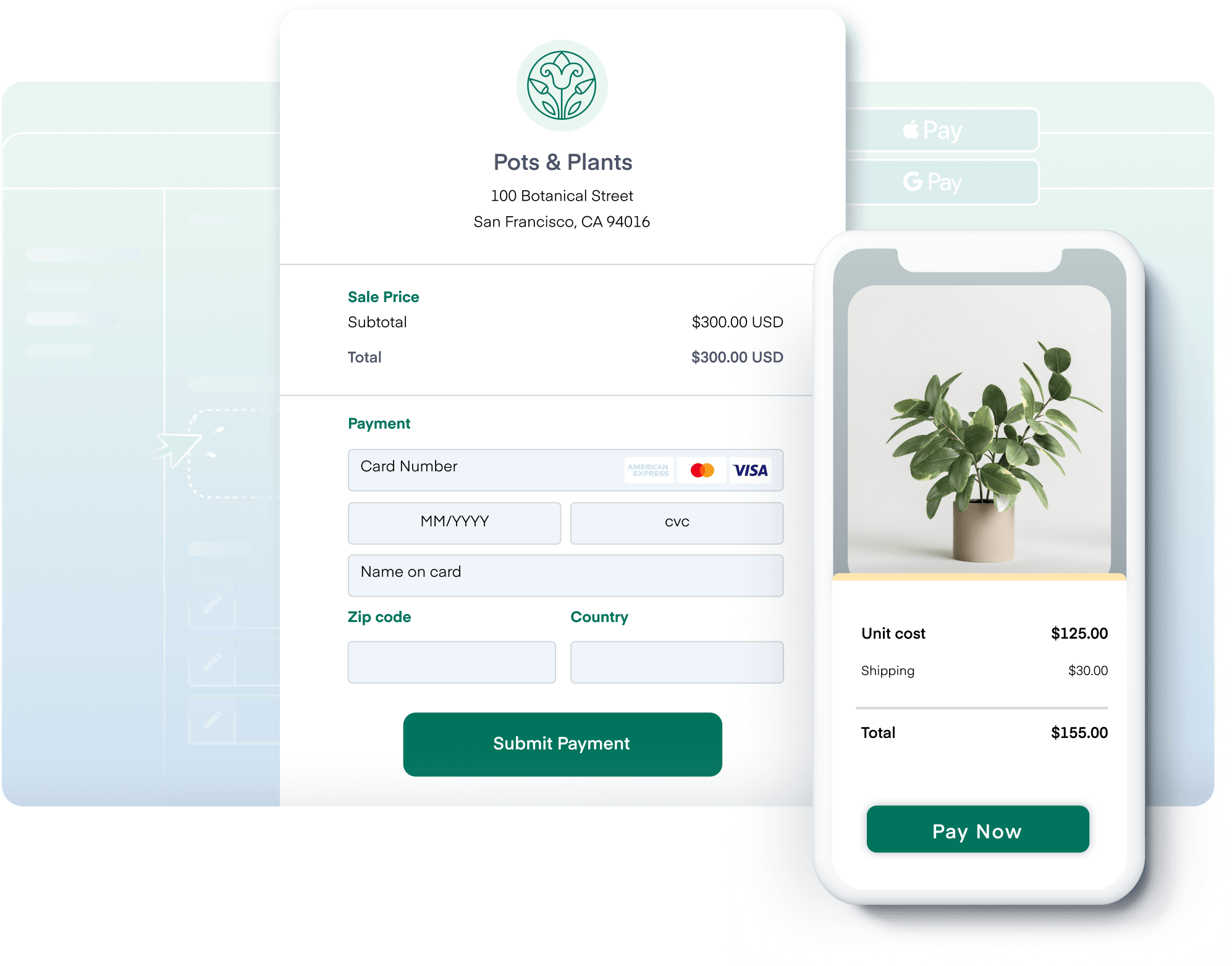

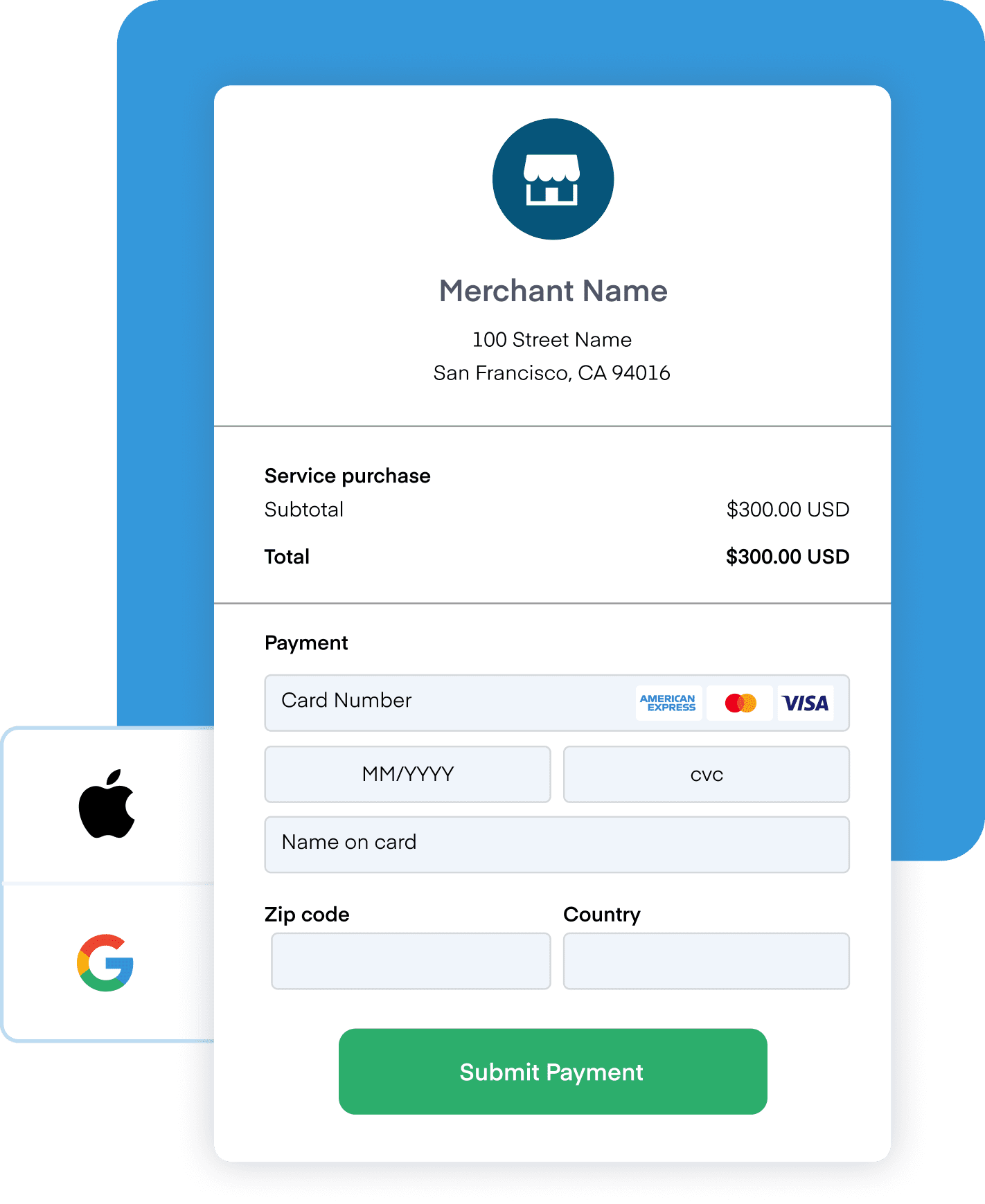

Our hosted checkout solutions allow you to instantly start accepting payments including Apple Pay and Google Pay and lower your PCI compliance scope. In addition, you have the flexibility to define the look, feel and styling and use Powered By Chase branding to add instant credibility to your payment processing capabilities.

Get up and running quickly with our ready-to-use full hosted onboarding experience. We handle the KYC process for you as well as allow your merchants to securely set up their payout bank information.

.svg?auto=webp)

Our one-stop self-serve portal that merchants can access via SSO and review transactions, handle disputes and chargebacks, run reports, review payouts and more. In addition, you can fully customize the branding that your merchants see.

Our hosted checkout solutions allow you to instantly start accepting payments including Apple Pay and Google Pay and lower your PCI compliance scope. In addition, you have the flexibility to define the look, feel and styling and use Powered By Chase branding to add instant credibility to your payment processing capabilities.

Get up and running quickly with our ready-to-use full hosted onboarding experience. We handle the KYC process for you as well as allow your merchants to securely set up their payout bank information.

Your wish list in payouts

Flexible payout schedules

Merchants can set a daily, weekly or monthly payout schedule.

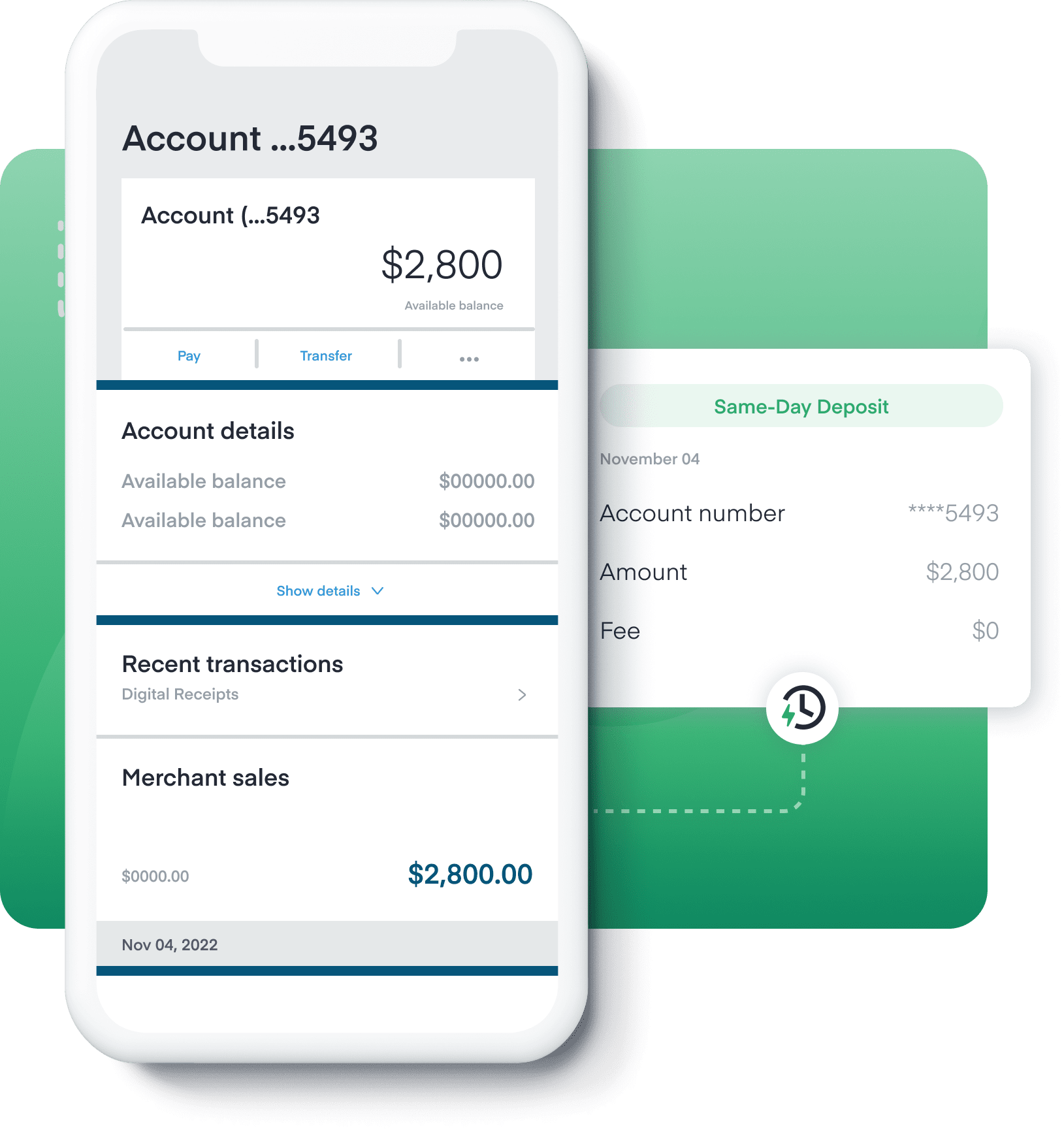

Same-Day deposits on us

Transactions approved by 5:00PM PT will be deposited by 9:30PM PT with no extra fees when depositing to a Chase business checking account.

Same-Day Deposits are available to eligible merchants of software platforms with a 5PM PT cut-off time for payments processed on WePay. Merchants must deposit into a single Chase bank account. Payments approved by 5PM PT are eligible. All transactions are subject to WePay terms of service and exclusions therein, including risk assessment and fraud monitoring, which may result in delays. Funds are deposited on business days, excluding weekends and bank holidays. Available in the U.S. only. Contact api@wepay.com for more information.

Everyday payouts

Merchants receiving payouts to Chase business checking account also receive payouts every day, including weekends and holidays.

Deliver a frictionless experience in any channel

Support online, mobile and card present payments

- Unify the merchant journey from onboarding to payouts.

- Streamline robust reporting and reconciliation for online and in-person sales.

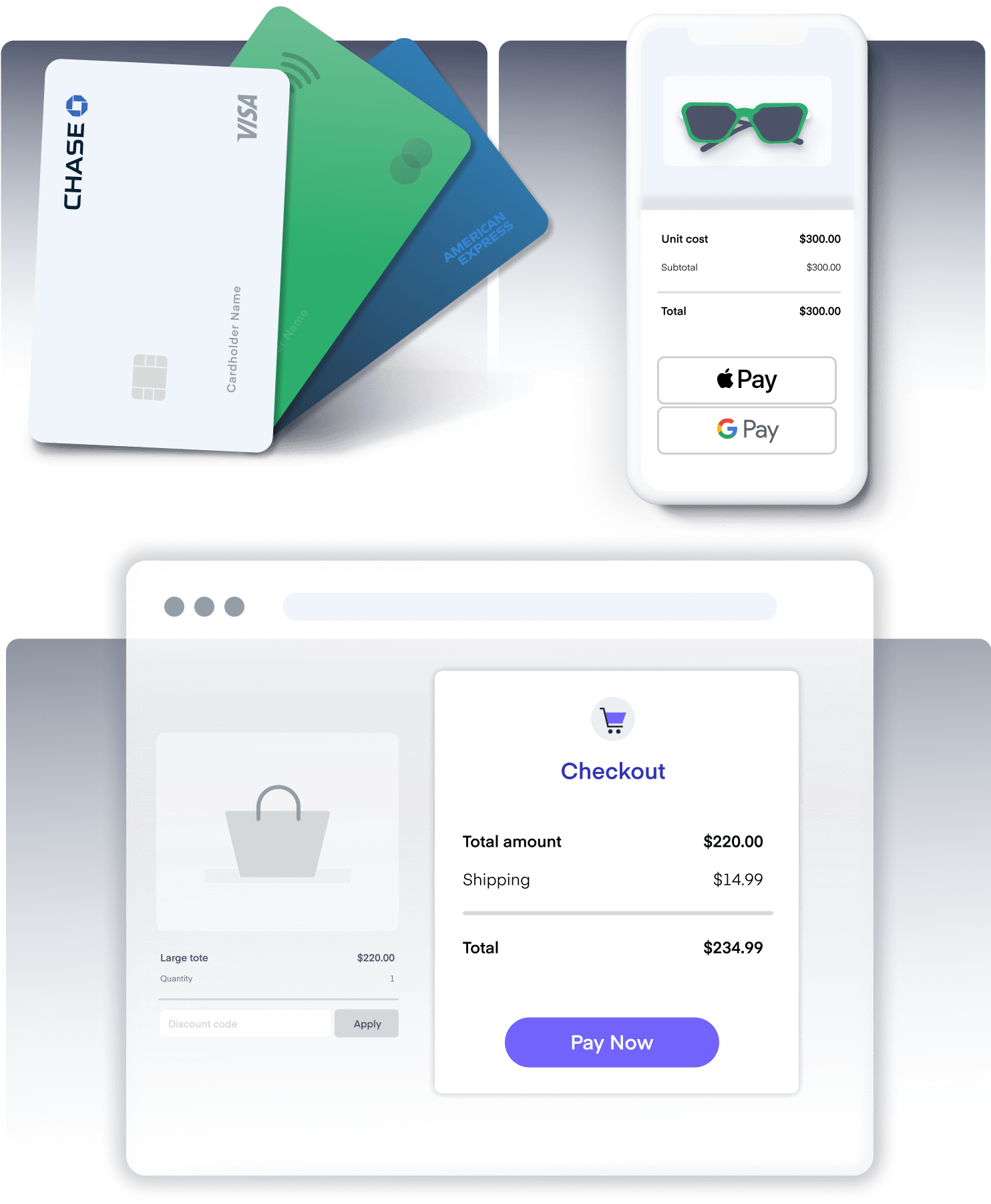

Seamlessly accept all cards across sales channels

- Accept all major payment methods including digital wallets.

- iOS and Android smartphones and tablets.

Rest easy with our robust risk capabilities

Authorize transactions fast

Enable high approvals and reduce negative user experiences due to declined transactions with automated decisioning informed by your data, complemented with WePay’s manual reviews.

.svg?auto=webp)

Enjoy peace of mind

Rest easy with fraud and chargeback loss protection while WePay handles KYC, AML and more.

Terms apply; risk types include: fraud, credit, compliance, AML, sanctions, and KYC

Complete control of the user experience

Modern, RESTful APIs

Integrate quickly with SDKs and open source code samples.

var myAppId = appId

var apiVersion = "3.0";

var error = WePay.configure("stage",myAppleId,apiVersion);

if error{console.log(error);}

var iframe_container_id ="credit_card_frame"

var creditCard =

Fully functional feature set

Onboarding

Progressive onboarding

White-label experience

Referrals from Chase

UK & Canada support

Support for merchant communication

Payments

Credit, Debit, e-check

Digital Wallets

Card Present Solutions

Account updater

Multiple Payment Capture Methods

Easy PCI-DSS Compliance

Card Vault / Tokenization

Payouts

Payment to Payout Reconciliation

Same-day deposits with no extra fees

Same-Day Deposits are available to merchants on integrated software platforms with a 5:00 pm PT cut-off time for payments processed on WePay. Merchants must deposit into a single Chase bank account to be eligibleFlexible Payout Schedules

Portfolio Management

Partner Center (reporting and analytics

Merchant Center (digital servicing)

Earnings & Performance Reporting

Terminal Management

Account History

Risk & Compliance

Custom Risk Management

Fraud and chargeback loss protection

AML / KYC Checks

1099-K Management